Seamless connections between blockchain networks represent the next evolution for digital assets. Crypto bridges enable frictionless movement between chains, unlocking tremendous utility for users no longer restricted to isolated “walled gardens” of liquidity and features.

Supporting accessible bridge infrastructure aligns with values of openness and inclusion here at Defi Way. As pioneers in decentralized finance, we track the bridges poised to stitch together the fragmented worlds of crypto into an interconnected financial mesh.

Overcoming Tribalism

Cryptocurrency emerged as a vision of open, borderless money transferring peer-to-peer without gatekeepers. Yet tensions persist between factions from the thousands of blockchain projects built in isolation since Bitcoin’s inception. Initiatives to bridge ecosystems challenge “maximalist” mentalities while aligning economic incentives.

Many chains cater to narrow design choices, constituencies and assets. Transitioning between these environments often requires slow manual processes via centralized exchanges. Platform lock-in and liquidity fragmentation restricts adoption and development.

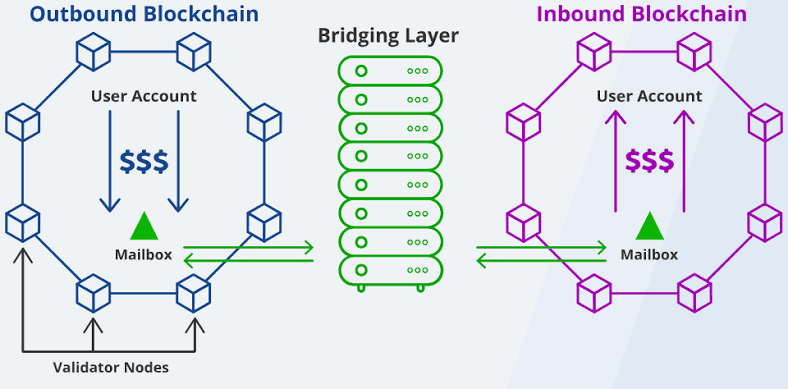

Interoperability promises to change this by enabling trustless asset transfers between blockchains. These bridges provide critical on-ramps for value to flow freely to optimal networks based on features and transaction costs. Soon users will traverse Cosmos, Polkadot and external chains in a seamless interface.

Of course some grail bridges promise more decentralization than they deliver. And work remains updating complex interfaces for the mainstream. But clear momentum builds behind blockchain connectivity to unlock latent potential. Defi Way looks forward to the bridges sure to follow.

Expanding Market Breadth and Depth

Well designed interoperability unlocks advantages including:

- Mitigating platform risk by diversifying holdings across multiple chains.

- Flexibility to add features, reduce costs, improve governance by relocating assets.

- Access to specialized apps and functionality enabled by bridged assets.

- Greatly enhanced trading, lending and transactions thanks to combined liquidity.

Already functioning bridges demonstrate these compounding network effects. The Total Value Locked (TVL) in Ethereum alone went from hundreds of millions to over $100 billion in two years, exhibiting exponential growth in part thanks to bridges allowing asset imports.

For example, ShapeShift’s ThorChain enables decentralized trading between thousands of coin pairings otherwise siloed or dependent on fragmented DEXs. Leading Ethereum decentralized exchanges like Uniswap plan to integrate with Thorchain to expand their offerings. These bridges attract liquidity that seeds vibrant derivative ecosystems like options and lending platforms bridging Bitcoin to Cosmos.

While bridges navigate complex obstacles, clear incentives drive investment into blockchain connectivity solutions. Defi Way looks forward to more intuitive interfaces and onboarding for the interwoven future ahead.

Surmounting Known Barriers

Beyond surface critiques around new technologies, bridges overcome barriers between the radically different transactional environments across blockchains. Networks rely on varied languages (Rust, Move, Solidity), security requirements, speeds, carbon footprints, culture and governance.

Bridging heterogeneous chains requires reconciling issues from confirmation times, finality, anonymity, and fee structures. Solutions must balance critical tradeoffs between decentralization, expandability, and ease of use.

Progress marches forward behind the scenes, but challenges persist. For example, differences in consensus finality mechanisms can cause reconciliation failures between chains and asset loss. Common messaging formats help, but remain fragmented. And some bridges introduce centralization risks around asset custodianship reminiscent of exchanges.

Still, an array of solutions mitigate these concerns while retaining user autonomy. Trust-minimized relay schemes distribute operations to validator pools using economic incentives. Decentralized custodians employ horizontals scaling, proof of reserves, and insurance backends. And modular designs allow flexibility across bridged environments.

Additionally, skepticism around cooperation across blockchain communities shows signs of easing among builders converging on frameworks like InterBlockchain Communication (IBC) and standaradized security models. Of course not all bridges align incentives properly, but Defi Way sees plenty of progress sustaining optimism.

Unlocking Open Potential

The next era will enable exponentially greater exchange between the thousands of blockchain networks flourishing today. Already billions in value flow daily across bridges like Hop Protocol, Axelar and More, but this only scratches the surface of a future transmitting trillions in bridged assets.

As bridges facilitate freer asset flow and access to specialized networks, they will compound latent advantages unique to specific blockchains. Soon effortlessly migrating between Cosmos hubs, Polkadot parachains and external chains will integrate strengths without compromising decentralized security assurances.

To unlock its highest purpose though, blockchain infrastructure must retain permissionless design principles. Solutions that maximize decentralization and user control represent the ideal. And progress towards these resilient intersections appears steady thanks to deep financial incentives and standardization efforts around key bridge components.

Of course challenges around security, scalability and governance remain. But Defi Way believes the path ahead looks bright for crypto bridges to resolve tradeoffs and connect this fragmented landscape into something greater than the sum of its parts. Because open networks hold potential to enrich all through collective innovation without borders. We look forward to tracking the bridges yet to come!

Leave a comment